The cryptocurrency market is a rapidly evolving space that has garnered significant attention from investors worldwide. For Europeans, the remainder of 2023 and the beginning of 2024 bring both opportunities and challenges in the crypto landscape. This article aims to provide an in-depth analysis of what to expect in the coming months, backed by current market trends and expert opinions.

Current Market Trends

As of September 2023, the cryptocurrency market shows a bullish outlook on Ethereum, with a significant $150 million bet placed by a crypto whale, according to CoinDesk. Additionally, research indicates that Ether is trading at a 27% discount to its fair market value, suggesting a potential upside. On the other hand, Aptos, a Layer 1 protocol, plans to release 20 million APT tokens worth over $100 million this November, which could impact market dynamics.

Key Takeaways:

- Bullish Outlook on Ethereum: A large flow of investment in out-of-the-money calls indicates a bullish outlook on Ethereum.

- Ether Undervalued: Research suggests that Ether is currently undervalued, offering a potential investment opportunity.

- Token Releases: The release of a significant number of APT tokens by Aptos could affect market liquidity and prices.

Investment Strategies for Europeans

Diversification

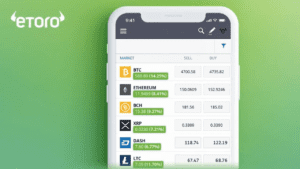

Given the volatile nature of cryptocurrencies, diversification remains a key strategy. Consider a mix of established coins like Bitcoin and Ethereum, along with emerging tokens and DeFi projects.

Regulatory Compliance

Europe has been proactive in regulating cryptocurrencies. Ensure that your investments comply with local and EU regulations to avoid legal complications.

Join the world's biggest trading network & get instant access to a personal account manager!

Risk Management

Implement robust risk management strategies, including setting stop-loss orders and only investing money you can afford to lose.

Future Predictions

- Increased Adoption of Layer 2 Solutions: With Ethereum 2.0 and other Layer 2 solutions gaining traction, expect faster and cheaper transactions.

- NFTs and Metaverse: The rise of NFTs and the Metaverse offers new investment avenues.

- Regulatory Developments: Keep an eye on regulatory changes, as they can significantly impact the crypto market.

Conclusion

For Europeans looking to invest in cryptocurrencies, the remainder of 2023 and early 2024 offer promising opportunities, particularly in Ethereum. However, it’s crucial to approach this with a well-thought-out strategy, keeping in mind the volatile nature of the market and the regulatory landscape.

Thought-Provoking Questions:

- Is Ethereum the New Safe Haven?: With a bullish outlook and undervaluation, should Ethereum be considered a safer bet compared to other cryptocurrencies?

- Impact of Token Releases: How will the release of new tokens like APT affect the liquidity and overall stability of the market?

- Regulatory Future: How might upcoming regulatory changes in the EU affect cryptocurrency investments?

For more in-depth analysis and investment strategies, stay tuned to invest2euro.com.