In recent years, the world has witnessed an explosion of interest in stock and cryptocurrency trading. Once the exclusive domain of professional traders and Wall Street aficionados, these financial markets have been democratized by technology, opening doors for retail investors globally. Europe has been no exception; the continent has seen an ever-increasing number of citizens dipping their toes into these exciting but complex realms.

One of the most transformative changes in the investment landscape has been the advent of mobile trading platforms. The convenience of buying and selling assets from the palm of your hand, even while on the go, has been nothing short of revolutionary. The barriers to entry have been shattered, and the trading floor is now as close as your smartphone or tablet.

The objective of this article is straightforward yet invaluable: to guide European citizens through the maze of popular apps available for buying stocks and cryptocurrencies. Whether you are a complete novice seeking to make your first investment or a seasoned trader looking to diversify your portfolio, this comprehensive guide aims to cover all the bases, providing you with actionable insights and meticulous details.

The Legal Landscape for Online Trading in Europe

Before diving into the nitty-gritty of trading platforms, it’s crucial to understand the regulatory environment governing online trading in the European Union. The EU has implemented stringent regulations to protect consumers and ensure fair and transparent trading practices. Institutions like the Financial Conduct Authority (FCA) in the UK, the Autorité des Marchés Financiers (AMF) in France, and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany, among others, oversee the functioning of these platforms.

Join the world's biggest trading network & get instant access to a personal account manager!

Why is this important? As an investor, you’ll want the assurance that you’re operating within a regulated framework that provides certain safeguards against fraud and mismanagement. Furthermore, knowing the regulations can also help you navigate the often complex waters of tax obligations related to capital gains and income from investments. Not all platforms are regulated equally, and some may not be authorized to operate in your jurisdiction, exposing you to unnecessary risks.

Given the stakes, understanding the terms and conditions, tax obligations, and the regulations of your jurisdiction is not just a box-ticking exercise; it’s an essential step for safe and effective trading. Reading the fine print may not be exciting, but it’s the bedrock upon which responsible investing is built.

By familiarizing yourself with the legal landscape, you equip yourself with the knowledge necessary to make informed decisions, thereby mitigating risks and increasing your chances of achieving favorable returns.

Stay tuned as we delve deeper into the specifics of popular trading apps accessible to European citizens, dissecting their features, advantages, and limitations.

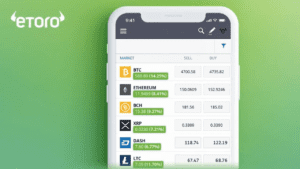

eToro: A Pioneer in Social Trading

Brief History and Introduction to eToro

Founded in 2007, eToro has rapidly evolved to become one of the world’s leading social trading platforms. With its origins rooted in the idea that the financial markets should be accessible to everyone, eToro aimed to simplify trading from its very inception. The platform has succeeded in revolutionizing the way people invest, blurring the lines between traditional investing and a social networking experience. Today, eToro boasts millions of users across over 140 countries, including a robust presence in various European nations.

Unique Features like “CopyTrading”

One of the standout features of eToro is “CopyTrading,” a social trading innovation that allows you to automatically copy the trades of successful, vetted traders. Imagine having the investment acumen of a seasoned trader at your fingertips, with the ability to replicate their trades in real-time, proportionally and automatically. With CopyTrading, you can allocate a portion of your capital to follow a specific trader’s moves, effectively allowing you to diversify your portfolio without requiring the extensive market knowledge that usually comes with such diversification.

This feature has been a game-changer for both novice and experienced traders. Novices benefit from the experience of seasoned investors, while experienced traders can earn additional revenue through follower engagement. Essentially, eToro has created a win-win environment that capitalizes on the power of collective intelligence.

Regulation and Safety Measures for European Citizens

When it comes to regulation and safety, eToro takes no shortcuts. The platform is regulated by several financial authorities globally, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). For European citizens, this dual regulation should provide a layer of reassurance, as both agencies are known for their stringent standards.

eToro employs industry-leading safety measures to protect users’ data and funds. Two-factor authentication (2FA), data encryption, and cold storage of the majority of client funds are just a few of the safeguards in place. Additionally, under the Financial Services Compensation Scheme (FSCS) and the Investor Compensation Fund (ICF), eligible clients may be entitled to compensation in the unlikely event that eToro faces insolvency.

European users will also appreciate the ease of compliance with tax regulations through straightforward reporting features available on eToro. These features simplify the often complex task of documenting capital gains and losses for tax purposes.

Other Popular Apps for European Citizens

Robinhood

Introduction and Key Features

Robinhood, the US-based trading app, shook the financial world when it debuted its commission-free trading model. The platform has democratized stock and crypto trading by eliminating traditional fees and offering a user-friendly interface. Some of its key features include the ability to trade a wide array of assets such as stocks, ETFs, options, and cryptocurrencies. It also provides an intuitive platform replete with educational resources, allowing novice investors to gain market knowledge.

Availability and Limitations in Europe

Although Robinhood has announced plans to expand internationally, its availability in Europe remains limited. Regulatory hurdles and the complexity of local financial markets have slowed its European roll-out. However, there are alternative platforms that offer a similar commission-free model, which we will discuss later. Therefore, while Robinhood may not be an option for all European citizens at this moment, it’s worth keeping an eye on its potential expansion in the future.

Fee Structure

While Robinhood is known for its commission-free trades, it’s essential to recognize that “free” does not mean “without cost.” The platform earns revenue through methods like “payment for order flow,” a controversial practice where Robinhood sells customers’ orders to market makers, potentially resulting in less favorable trade execution. Additionally, the app charges fees for premium services like Robinhood Gold, which offers features such as professional research reports and margin trading.

Trading 212

Introduction and Key Features

Trading 212 is a UK-based fintech company that has carved a niche for itself in the European trading landscape. The app is known for its sleek design, user-friendly interface, and a broad range of asset choices. You can trade stocks, forex, commodities, and even cryptocurrencies. One of its key features is the “Practice Mode,” which allows users to engage in risk-free trading with virtual money—an excellent option for beginners who want to test strategies before investing real capital.

Regulation and Availability in Europe

Being headquartered in the UK, Trading 212 is regulated by the Financial Conduct Authority (FCA). This stringent regulatory oversight makes it a reliable option for European investors. After Brexit, the company has made adjustments to comply with EU financial regulations, ensuring continued access for European citizens. It is available in most European countries, offering the advantage of trading in multiple currencies.

Fee Structure

Trading 212 gained popularity by being one of the first platforms in Europe to offer commission-free trading. However, like Robinhood, it’s essential to understand where the platform earns its revenue. Trading 212 primarily generates income through the spread—the difference between the buying and selling price of an asset. Though spreads are generally minimal, they can add up for high-volume traders. The platform also offers a CFD (Contract for Difference) account, which comes with its own set of fees and should be approached with caution due to the high risk associated with CFD trading.

Revolut

Introduction and Key Features

Revolut began as a fintech company aiming to revolutionize the traditional banking sector. It quickly expanded its offerings to include investment services. With Revolut, users can purchase stocks, commodities, and cryptocurrencies, all within a single, user-friendly app. It offers a broad range of financial products, from foreign exchange services to budgeting tools, alongside its trading features.

How It Differs from Traditional Trading Platforms

Revolut differs substantially from traditional trading platforms in its all-in-one approach. It integrates banking, payments, and investing into a single unified platform. This creates a seamless user experience where you can, for instance, receive your paycheck, pay your bills, and invest in stocks or cryptocurrencies without having to switch between different apps or platforms. While traditional trading platforms focus solely on investments, Revolut aims to be a one-stop-shop for all your financial needs.

Availability in Europe and Fee Structure

Revolut is widely available across Europe and is regulated by financial authorities in various jurisdictions, making it a secure and compliant option for European citizens. The fee structure is fairly transparent, with no fees for basic stock trading up to a certain limit per month. Beyond that, a nominal fee is charged per trade. Cryptocurrency trading comes with a markup on the spread but is otherwise free from additional fees. Premium and Metal subscribers receive added benefits like free trades and reduced foreign exchange fees.

Coinbase

Introduction and Focus on Cryptocurrency Trading

Coinbase is one of the world’s leading cryptocurrency platforms, founded in the United States in 2012. Its primary focus is to offer an accessible gateway into the complex world of cryptocurrencies. With Coinbase, users can buy, sell, and store a wide variety of cryptocurrencies, from Bitcoin and Ethereum to many smaller altcoins.

Regulation and Safety Features

Coinbase is highly regulated and adheres to stringent security measures, making it a secure option for European investors. Although it is a U.S.-based company, Coinbase complies with European regulations and offers additional features like insured digital wallets. Two-factor authentication (2FA) and cold storage for the majority of digital assets add extra layers of security.

Fee Structure

Coinbase operates on a straightforward fee structure that includes a flat fee for transactions below a certain amount, with variable fees for larger trades. The platform also charges a spread for cryptocurrency purchases and sales. These fees can accumulate quickly, so users need to be mindful when making multiple trades or smaller transactions.

Binance

Introduction and a Range of Crypto Options

Binance, another giant in the cryptocurrency trading space, was founded in 2017. Despite its relatively short history, Binance has become one of the largest crypto exchanges in the world. It offers a staggering variety of cryptocurrencies for trading, far outpacing competitors like Coinbase. From mainstream options like Bitcoin and Ethereum to numerous altcoins and even tokenized versions of traditional financial assets, the selection is vast.

How Binance Complies with European Regulations

Binance has made concerted efforts to comply with European regulations. It has introduced features tailored to European customers, such as fiat-to-crypto conversions using the Euro, and complies with the EU’s anti-money laundering directives. However, it’s worth noting that Binance has faced regulatory scrutiny in various jurisdictions, so it’s crucial to stay updated on its regulatory status within Europe.

Fee Structure

Binance operates on a tiered fee structure based on trading volume. For most retail investors, the fees start at a relatively low percentage and can decrease with higher trading volumes. Unlike many other platforms, Binance offers a “maker-taker” fee schedule, rewarding users who provide liquidity to their market.

Specialized Apps for Professional Traders

The trading landscape is as diverse as the traders it serves, ranging from casual investors to high-frequency professional traders. While apps like eToro, Robinhood, and Revolut are ideal for the general populace, there are specialized platforms built to serve the nuanced and complex needs of professional traders. These platforms come with a robust set of tools, a wide array of tradable assets, and are equipped to handle high volumes of trading with minimal latency. Let’s delve into some of these specialized apps aimed at professional traders.

MetaTrader 4/5

Introduction and Features

MetaTrader, developed by MetaQuotes Software, is arguably the most renowned trading platform for forex and CFD traders. With two versions available—MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—the platform offers a robust suite of features. These include advanced charting tools, multiple timeframes, a wide array of technical indicators, and automated trading capabilities via Expert Advisors (EAs).

Why Professionals Choose MetaTrader

MetaTrader stands out for its customizability and automation. The ability to develop, backtest, and implement trading algorithms through Expert Advisors makes it exceptionally appealing for traders who operate on complex strategies. Its low latency and robustness can handle high-frequency trading, making it suitable for professional traders.

Availability and Costs

MetaTrader is globally available and commonly offered through various brokerage firms. While the software itself is free to download, traders may incur costs through spreads, commissions, or additional services provided by the broker they choose to trade through.

Interactive Brokers (IBKR)

Introduction and Features

Interactive Brokers is a U.S.-based brokerage firm known for its deep access to global markets, a comprehensive set of tradable assets, and a high-quality trading platform. It offers stocks, options, futures, forex, and bonds, among other assets. The Trader Workstation (TWS), its primary trading platform, is a powerful tool with advanced charting, risk management features, and a customizable interface.

Why Professionals Choose Interactive Brokers

Interactive Brokers is particularly popular among professional traders due to its low trading costs, high-speed order execution, and extensive research tools. Its Risk Navigator tool is a boon for traders who need to manage complex portfolios with multiple asset classes.

Availability and Costs

Interactive Brokers serves clients globally, including Europe. The fee structure is highly competitive, especially for high-volume traders. Fees can vary based on the asset class and trading volume, but they are generally lower than industry standards for professional traders.

Saxo Bank

Introduction and Features

Based in Denmark, Saxo Bank is a leading fintech company that specializes in online trading and investment. It offers an extensive range of tradable assets, including stocks, forex, commodities, and even cryptocurrencies. Its proprietary trading platform, SaxoTraderGO, is web-based and offers a highly intuitive user interface along with powerful analytical tools.

Why Professionals Choose Saxo Bank

Saxo Bank caters to professional traders through its advanced trading platforms, SaxoTraderGO and SaxoTraderPRO, offering advanced charting tools, an extensive range of order types, and algorithmic orders. Its commitment to transparency and a robust set of research and analysis tools make it a favored choice for professionals.

Availability and Costs

Saxo Bank serves clients worldwide, including European countries. The fee structure is transparent, with competitive spreads and commissions. However, some of its advanced features and lower trading costs are reserved for clients who meet the minimum account balance requirements, which are generally on the higher side.

How to Choose the Right Platform

The Importance of Understanding Your Investment Goals

The first step in choosing the right trading platform is an introspective one. You must clearly define your investment goals and the strategy you plan to use to achieve them. Are you a long-term investor looking to build a diversified portfolio? Or are you a day trader, seeking to capitalize on short-term market fluctuations? Different platforms cater to different investment styles, offering features that can either aid or hinder your particular approach. Therefore, aligning your trading platform with your investment goals is crucial for success.

Considerations Like Fees, Range of Available Assets, and User Experience

Once you’ve defined your investment goals, you can begin to look at the practical elements of each platform:

- Fees: Cost is an often-overlooked but essential factor. Trading fees, spreads, and any additional costs like withdrawal or inactivity fees can quickly eat into your profits.

- Range of Available Assets: Depending on your investment strategy, you may want a platform that offers a wide variety of asset classes. For instance, some traders may prefer a platform that offers both stock and crypto trading options to diversify their portfolio.

- User Experience: The platform’s interface and user experience can greatly impact your trading efficiency. Look for platforms that offer an intuitive layout, robust customer support, and additional features like educational resources or analytical tools.

Regulatory Compliance and Safety

It’s crucial to ensure that the platform you choose complies with relevant financial regulations and has robust safety measures in place. Look for platforms that are regulated by reputable financial bodies. They should also offer security features like two-factor authentication and cold storage for digital assets. Always check user reviews and expert opinions to gauge the platform’s reliability.

Extra Tips for New Traders

Importance of Due Diligence

Before diving headfirst into the world of trading, one must not underestimate the value of thorough research or ‘due diligence.’ Get to know the assets you’re interested in, understand market trends, and follow news that could impact your investments. Make use of the plethora of free resources available online to equip yourself with the knowledge you need.

Risks Associated with Stock and Crypto Trading

Trading, by its very nature, is risky. Stocks and cryptocurrencies are subject to market volatility. While stocks are influenced by both market conditions and corporate performance, cryptocurrencies can be exceptionally volatile and influenced by a range of factors from technological developments to regulatory news. Therefore, it’s vital to understand your risk tolerance and to never invest money that you can’t afford to lose.

Diversification as a Risk Mitigation Strategy

One of the golden rules of investing is never to put all your eggs in one basket. Diversification, the practice of spreading your investments across different types of assets, can help mitigate risk. However, it’s important to diversify intelligently—don’t just buy different assets for the sake of it. Your diversified portfolio should align with your overall investment strategy and financial goals.

Conclusion

The trading landscape for European citizens is rich and varied, offering platforms to suit every level of investor, from the casual to the professional. Each platform brings a unique set of features and advantages to the table. Apps like eToro and Robinhood offer user-friendly interfaces and social trading elements. Revolut blends the lines between banking and investing, Coinbase specializes in cryptocurrencies, and Binance offers a vast selection of crypto assets. For professional traders, MetaTrader, Interactive Brokers, and Saxo Bank provide robust, feature-rich environments ideal for complex strategies and high-volume trading.

However, the best trading platform for you ultimately depends on your specific needs and goals. Before diving in, take the time to understand your investment objectives, risk tolerance, and the types of assets you want to trade. Equally important is the consideration of regulatory compliance and security features to ensure a safe trading experience. No single platform will be the best choice for everyone; the optimal platform for you will align closely with your individual needs and investment strategy.

Further Resources

To deepen your understanding of trading, investment strategies, and market dynamics, consider exploring the following resources:

Websites

- Investopedia: A comprehensive resource for all things related to finance and investing.

- The Motley Fool: Known for its stock recommendations and investment advice.

- CryptoCompare: Provides detailed information about various cryptocurrencies, including market trends and data.

- Financial Times: For keeping up-to-date with global financial news.

Books

- “The Intelligent Investor” by Benjamin Graham: A seminal book on value investing.

- “Market Wizards” by Jack D. Schwager: Provides insights into the strategies of various successful traders.

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar: A deep dive into investing in crypto assets.

Courses

- Udemy’s “Complete Financial Analyst Training & Investing Course”: Covers a range of topics from stock trading to corporate finance.

- Coursera’s “Financial Markets”: Taught by Yale Professor Robert Shiller, this course gives you a broad understanding of financial markets.

- edX’s “Professional Certificate in Machine Learning for Finance”: For those interested in algorithmic trading.

By investing in your education and understanding, you’ll be better equipped to navigate the complexities of the financial markets effectively. Whether you’re just starting your investment journey or looking to refine your strategies, continuous learning is key to success.