Introduction to Online Investing and Trading

As the world becomes increasingly interconnected, more individuals are turning to online investing and trading to grow their wealth. With a wide range of investment options available, it’s important to understand the basics of online investing and explore the different opportunities it offers.

Understanding Online Investing

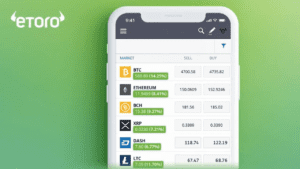

Online investing refers to the process of using digital platforms and tools to buy, sell, and manage various financial assets. This method of investing provides individuals with the convenience of accessing global markets from the comfort of their own homes. Whether you’re interested in forex trading, cryptocurrencies, ETFs, or stock trading, online investing platforms offer a range of opportunities to suit different investment goals.

One of the key advantages of online investing is the ability to access real-time market information and execute trades at your convenience. This allows investors to stay informed about market trends, monitor their portfolio, and make timely investment decisions. Additionally, online investing platforms often provide educational resources and tools to help investors make informed choices and understand the risks involved.

Exploring Different Investment Options

When it comes to online investing, there are numerous investment options to choose from, each with its own unique characteristics and potential returns. Here are a few popular options to consider:

Join the world's biggest trading network & get instant access to a personal account manager!

-

Forex Trading: The forex market is the largest and most liquid financial market in the world, with an average daily trading volume of $6.6 trillion (Money.com). Forex trading involves buying and selling currencies with the aim of profiting from fluctuations in exchange rates. It offers the potential for both profits and losses, and traders need to have a thorough understanding of the market and its risks before getting involved.

-

Cryptocurrencies: Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant popularity in recent years. These digital currencies operate on decentralized networks and offer potential opportunities for investors. Cryptocurrency exchanges provide a platform for buying, selling, and trading cryptocurrencies, allowing investors to take advantage of price movements in this volatile market.

-

ETFs: Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges. They offer diversification by tracking a specific index, sector, or asset class. ETFs provide investors with exposure to a wide range of assets, such as stocks, bonds, or commodities, without the need to directly own individual securities.

-

Stock Trading: Stock trading involves buying and selling shares of publicly traded companies. It allows investors to participate in the ownership of companies and potentially benefit from capital appreciation and dividends. Online stock trading platforms provide access to a wide range of stocks listed on various stock exchanges.

As you embark on your online investing journey, it’s important to consider your investment goals, risk tolerance, and time horizon. Each investment option comes with its own set of risks and potential rewards, so it’s essential to conduct thorough research and seek professional advice if needed.

By understanding the fundamentals of online investing and exploring the different investment options available, you can make informed decisions and take advantage of the opportunities presented by the global market. Remember to choose a reliable online brokerage or trading platform that suits your needs, develop a trading plan, and continuously educate yourself to enhance your investing skills.

Forex Trading: An Overview

In the world of global financial markets, forex trading holds a prominent position. It involves buying one currency and selling another currency simultaneously, with the aim of profiting from the changes in exchange rates. Forex trading is the largest and most liquid financial market in the world, with an average daily trading volume of $6.6 trillion (Money.com).

What is Forex Trading?

Forex trading refers to the buying and selling of foreign currencies in order to make a profit by predicting the value of one currency compared to another. This market operates 24 hours a day, five days a week, allowing traders to participate at any time that suits their schedule. Forex trading is typically conducted through brokers or financial institutions that provide access to the forex market (Money.com).

Major Currencies in Forex Trading

In forex trading, currencies are traded in pairs. The most commonly traded currencies in the forex market include the US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), Australian dollar (AUD), Canadian dollar (CAD), and Swiss franc (CHF). These currencies are considered major currencies due to their significant presence in global trade and financial markets (Money.com).

Here are some examples of commonly traded currency pairs:

| Currency Pair | Description |

|---|---|

| EUR/USD | Euro against US dollar |

| GBP/USD | British pound against US dollar |

| USD/JPY | US dollar against Japanese yen |

| AUD/USD | Australian dollar against US dollar |

| USD/CAD | US dollar against Canadian dollar |

| USD/CHF | US dollar against Swiss franc |

Getting Started with Forex Trading

Getting started with forex trading requires understanding the fundamental principles of the market and equipping oneself with the necessary knowledge and tools. Here are some key steps to begin your forex trading journey:

-

Educate Yourself: Take the time to learn about forex trading and the various strategies and analysis techniques used by traders. Familiarize yourself with the terminology, trading platforms, and risk management practices.

-

Choose a Reliable Forex Broker: Selecting a reputable forex broker is crucial for a smooth trading experience. Look for brokers that are regulated, offer competitive spreads, provide a user-friendly trading platform, and offer educational resources for traders.

-

Open a Trading Account: Once you have chosen a forex broker, you will need to open a trading account. This will give you access to the forex market, where you can execute trades and monitor your positions.

-

Develop a Trading Plan: Establish a trading plan that outlines your trading goals, risk tolerance, and trading strategies. A well-defined plan will help guide your decision-making process and keep emotions in check during trading.

-

Practice with a Demo Account: Many forex brokers offer demo accounts that allow you to practice trading with virtual money. Utilize this opportunity to familiarize yourself with the trading platform, test different strategies, and gain confidence before trading with real money.

-

Start Trading: Once you feel comfortable and confident with your trading skills, you can begin trading with real money. Start with small trade sizes and gradually increase your position sizes as you gain more experience and knowledge.

Remember, forex trading involves both potential rewards and risks. It requires continuous learning, adaptability, and disciplined risk management practices. By understanding the basics of forex trading and following best practices, you can navigate this dynamic market and potentially profit from global currency fluctuations.

The Benefits and Risks of Forex Trading

Before diving into the world of forex trading, it’s important to understand the advantages it offers as well as the risks and challenges involved.

Advantages of Forex Trading

Forex trading, also known as foreign exchange trading, provides several benefits for traders:

-

Liquidity: With a daily trading volume of over $6 trillion, the forex market is highly liquid, making it easy to enter and exit positions. Traders can take advantage of this liquidity to quickly execute trades and potentially profit from price fluctuations.

-

24-Hour Market: Unlike other financial markets, the forex market operates 24 hours a day, five days a week. This flexibility allows traders to participate in trading activities at their convenience, regardless of their time zone.

-

Global Accessibility: Thanks to technological advancements, forex trading is accessible to traders worldwide. It doesn’t require a large capital investment, and traders can start with smaller accounts. Online trading platforms provide access to global markets, offering a wide range of currency pairs to trade.

-

High Potential for Profits: Forex trading offers the potential for significant profits. Traders can take advantage of leverage to amplify their trading positions, allowing them to control larger positions with a smaller amount of capital. However, it’s important to note that leverage can also magnify losses.

-

Diverse Trading Opportunities: The forex market provides a wide range of trading opportunities, with various currency pairs available for trading. Traders can capitalize on both rising and falling markets, opening the door to potential profits in any market condition.

Risks and Challenges in Forex Trading

While forex trading offers potential rewards, it also comes with inherent risks and challenges:

-

Volatility: The forex market is known for its volatility, which can lead to rapid and significant price movements. While volatility presents opportunities for profits, it also increases the risk of losses. Traders must be prepared to navigate and manage these fluctuations effectively.

-

Complexity: Forex trading is highly complex, requiring a deep understanding of economic factors, political events, and market dynamics. Successful traders need to perform thorough analysis, develop trading strategies, and stay updated with market news and trends.

-

Leverage and Margin: Forex trading often involves the use of leverage, allowing traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses. Traders must exercise caution, manage risk, and use leverage responsibly.

-

Market Risks: Various factors can impact the forex market, including economic indicators, political events, and market sentiment. Sudden changes in these factors can lead to volatile market conditions, making it challenging for traders to predict and navigate market movements.

-

Emotional Challenges: Forex trading can evoke strong emotions, such as fear and greed, which can cloud judgment and lead to impulsive decision-making. Traders need to develop discipline, emotional control, and effective risk management strategies to navigate the psychological challenges of trading.

To mitigate risks and increase the chances of success, traders should educate themselves, develop a solid trading plan, utilize risk management strategies, and continuously learn and adapt to changing market conditions.

Understanding the advantages and risks of forex trading is essential for individuals looking to venture into this market. By being aware of these factors, traders can make informed decisions, manage their risks effectively, and work towards achieving their trading goals.

Strategies for Successful Forex Trading

When it comes to forex trading, having a well-defined strategy is essential for achieving success in the market. Traders employ various strategies to capitalize on market movements and increase their chances of profitable trades. In this section, we will explore four popular strategies: trend following, breakout trading, range trading, and carry trading.

Trend Following Strategy

One of the most common forex trading strategies is trend following. This strategy involves identifying and trading in the direction of the prevailing trend in the market. Traders using this strategy aim to capitalize on the momentum of the market by entering trades that align with the established trend. This approach can be effective in trending markets where prices consistently move in one direction.

To implement the trend following strategy, traders typically use technical indicators such as moving averages or trendlines to identify the direction of the trend. Once the trend is determined, traders will look for opportunities to enter trades in the direction of the trend, either buying in an uptrend or selling in a downtrend. It’s important to note that trend following strategies may not perform well in markets with limited or no clear trends.

Breakout Trading Strategy

Another popular forex trading strategy is breakout trading. This strategy involves entering the market when the price breaks out of a key level of support or resistance. Breakout traders aim to capitalize on the potential acceleration in price movement after the breakout occurs. This strategy is particularly suitable for traders who prefer more active and volatile markets.

Traders using the breakout trading strategy closely monitor support and resistance levels and wait for a breakout above resistance or below support. Once a breakout occurs, traders enter trades in the direction of the breakout, anticipating that the price will continue to move in that direction. It’s important to note that false breakouts can occur, so traders often use additional indicators or confirmation signals to validate the breakout.

Range Trading Strategy

Range trading is a forex trading strategy that involves identifying and trading within a range-bound market. In a range-bound market, the price oscillates between established support and resistance levels. Range traders aim to buy at support and sell at resistance, taking advantage of the repetitive price movements within the range.

Traders using the range trading strategy closely monitor support and resistance levels and wait for the price to reach these levels before entering trades. Once the price reaches support, traders look for buying opportunities, and when the price reaches resistance, they look for selling opportunities. Risk management is crucial in range trading, as traders must be prepared for potential breakouts that can invalidate the range.

Carry Trading Strategy

Carry trading is a forex trading strategy that involves borrowing in a low-interest-rate currency and using the funds to invest in a high-interest-rate currency, capturing the interest rate differential. This strategy aims to profit from both currency appreciation and interest rate differentials.

Traders using the carry trading strategy carefully select currency pairs with significant interest rate differentials. They go long on the high-interest-rate currency and short on the low-interest-rate currency. By holding the positions, traders earn interest on the high-interest-rate currency and pay interest on the low-interest-rate currency. It’s important to note that carry trading involves risks, including exchange rate fluctuations and changes in interest rates.

Implementing a well-defined strategy is crucial in forex trading. Traders should choose a strategy that aligns with their trading style, risk tolerance, and market conditions. It’s important to continuously evaluate and adapt strategies based on market dynamics and to practice proper risk management techniques. By developing and sticking to a strategy, traders can improve their chances of success in the forex market.

Factors Influencing Forex Markets

Forex markets are influenced by a variety of factors that can impact the exchange rates between currencies. Understanding these factors is crucial for successful forex trading. Here are some key factors that play a significant role in shaping the forex markets:

Economic Factors

Economic factors have a substantial impact on exchange rates. Factors such as inflation, interest rates, and economic growth can influence the value of a currency. Central banks often adjust interest rates to control inflation and stabilize their currencies (Investopedia). When a country’s interest rates are higher, it may attract foreign investors seeking higher returns, leading to an appreciation of its currency. Conversely, lower interest rates may discourage foreign investors, resulting in a depreciation of the currency.

Political Factors

Political stability and geopolitical events can also significantly influence exchange rates. Political turmoil, elections, or conflicts can cause volatility in currency values (Investopedia). A stable political environment is generally favorable for a currency, while uncertainty and instability can lead to a depreciation.

Speculation and Market Sentiment

Speculation and market sentiment play a crucial role in forex trading. Traders and investors often make decisions based on their expectations of future exchange rate movements (Investopedia). Positive market sentiment towards a currency can lead to an increase in demand, strengthening its value. Conversely, negative sentiment can result in a decline in demand and a weakening currency.

Trade Balances and Current Account

Trade balances and current account deficits or surpluses can impact exchange rates. A country with a trade surplus (exports exceeding imports) tends to have a stronger currency, as it demonstrates a strong economy and high demand for its goods and services (Investopedia). On the other hand, a country with a trade deficit (imports exceeding exports) may experience a weaker currency.

It’s important for forex traders to stay informed about these factors and their potential impact on the currency pairs they are trading. By monitoring economic indicators, political developments, market sentiment, and trade balances, traders can make more informed decisions and navigate the forex markets more effectively.

In addition to these factors, other influences such as central bank interventions, market liquidity, and global economic events can also affect exchange rates. Successful forex traders analyze these factors and use them to inform their trading strategies. Keeping a close eye on economic and political news, as well as staying updated with market analysis, can help traders gain an edge in the dynamic world of forex trading.

Understanding Forex Market Volatility

In the world of forex trading, volatility plays a crucial role. Understanding and managing volatility is essential for successful trading in the foreign exchange market. In this section, we will explore the concept of volatility in forex trading and discuss strategies for effectively managing it.

Volatility in Forex Trading

Volatility refers to the degree of variation or fluctuation in the price of a currency pair over a specific period. In simpler terms, it measures the rapidity and extent of price movements. Forex trading is inherently volatile due to various factors such as economic indicators, geopolitical events, and market sentiment.

One of the main risks in forex trading is volatility, as currency prices can fluctuate rapidly and unpredictably. Sudden price movements can lead to significant gains or losses. It’s crucial for traders to be aware of the potential volatility in the forex market and adapt their strategies accordingly.

The forex market is the largest and most liquid market in the world, with an average daily trading volume of $5.3 trillion. The high liquidity and trading volume contribute to increased volatility. Traders should stay informed about economic news releases, central bank announcements, and other factors that can impact currency prices to effectively navigate market volatility.

Managing Volatility in Forex Trading

While volatility presents opportunities for profit, it also carries risks. Managing volatility is essential for minimizing potential losses and maximizing trading opportunities. Here are some strategies that traders can employ to manage volatility effectively:

-

Risk Management: Implementing proper risk management techniques is crucial in forex trading. This includes setting appropriate stop-loss orders and take-profit levels to limit potential losses and protect profits. Traders should also determine their risk tolerance and allocate an appropriate portion of their capital to each trade.

-

Technical Analysis: Utilizing technical analysis tools and indicators can help traders identify trends and potential price movements. By analyzing historical price data, chart patterns, and indicators such as moving averages or Bollinger Bands, traders can make informed decisions and anticipate potential volatility.

-

Fundamental Analysis: Keeping up with economic indicators, political events, and other market-moving news is essential for understanding the underlying factors that can drive volatility in the forex market. Fundamental analysis helps traders assess the economic health of countries and make informed trading decisions based on the potential impact of news releases.

-

Diversification: Diversifying the currency pairs traded can help spread risk and reduce the impact of volatility on overall trading results. By trading multiple currency pairs with different characteristics, traders can potentially offset losses in one currency pair with gains in another.

-

Staying Informed: Continuous learning and staying updated with market news and developments are vital for managing volatility. Traders should follow reputable financial news sources, participate in online forums or communities, and keep an eye on economic calendars to stay informed about upcoming events that may cause fluctuations in the forex market.

Remember, forex trading involves significant risks, including the potential for substantial financial losses. It is highly complex and requires knowledge, research, and monitoring. Therefore, traders should approach forex trading with caution and adopt risk management practices to navigate market volatility effectively.

By understanding the concept of volatility and implementing appropriate strategies, traders can position themselves to take advantage of potential opportunities while minimizing the risks associated with market fluctuations.

The Role of Leverage in Forex Trading

When it comes to forex trading, leverage plays a significant role in amplifying potential gains and losses. Leverage allows traders to control larger positions with a smaller amount of capital, increasing the potential for higher profits. However, it’s important to note that leverage also magnifies the risk of losses. Therefore, understanding leverage and its implications is crucial for successful forex trading.

Leverage in Forex Trading

Leverage in forex trading refers to the ability to control a larger position in the market with a smaller initial investment. It is expressed as a ratio, such as 50:1, 100:1, or even higher. For example, with a leverage ratio of 100:1, a trader can control a position that is 100 times larger than their actual investment. This means that a small percentage change in the value of the traded currency pair can result in significant gains or losses.

The use of leverage in forex trading offers traders the opportunity to make substantial profits with a relatively small amount of capital. However, it’s important to approach leverage with caution as it also increases the risk of significant losses. It is recommended for traders to carefully assess their risk tolerance, set appropriate stop-loss orders, and manage their positions effectively to mitigate potential losses.

Understanding Margin and Leverage

Margin is closely related to leverage in forex trading. When trading with leverage, traders are required to deposit a certain percentage of the total trade’s value as collateral, known as the margin. The margin acts as a security deposit and is typically a fraction of the total trade size. The margin requirement varies depending on the leverage ratio and the broker’s policies.

For example, if a broker offers a leverage ratio of 50:1, the margin requirement would be 2% (1/50). This means that for a trade worth $10,000, the trader would need to deposit $200 as margin. The remaining $9,800 would be provided by the broker as leverage.

It’s important to note that while leverage can amplify potential gains, it can also lead to substantial losses. Traders should be cautious when using leverage and ensure they have a solid understanding of risk management strategies. This includes setting appropriate stop-loss orders, conducting thorough analysis, and continuously monitoring market conditions.

By comprehending the role of leverage in forex trading and understanding margin requirements, traders can make informed decisions and effectively manage their risk exposure. It is advisable to seek educational resources, consult reputable sources, and consider working with a reliable forex broker that offers transparent leverage terms and risk management tools.

The Importance of Fundamental and Technical Analysis

In the world of forex trading, both fundamental and technical analysis play crucial roles in informing trading decisions. Let’s explore each of these analysis methods in detail.

Fundamental Analysis in Forex Trading

Fundamental analysis in forex trading involves analyzing economic factors that have a significant impact on exchange rates. Traders who employ fundamental analysis examine various factors such as inflation, interest rates, economic growth, and geopolitical events to assess the overall health and stability of a country’s economy. Central banks often adjust interest rates to control inflation and stabilize their currencies.

By studying economic indicators and news releases, forex traders can gain insights into the potential future movements of currency pairs. For example, if a country’s economy is experiencing strong growth and low inflation, it may indicate a favorable environment for that country’s currency to appreciate against others.

Fundamental analysis helps traders make informed decisions by understanding the underlying economic factors that influence exchange rates. By keeping a close eye on economic indicators and staying informed about political stability and geopolitical events, traders can better anticipate potential shifts in currency values.

Technical Analysis in Forex Trading

In contrast to fundamental analysis, which focuses on economic factors, technical analysis in forex trading involves using various tools and indicators to analyze historical price and volume data. Traders using technical analysis aim to identify patterns, trends, and potential support and resistance levels in order to predict future price movements.

Technical analysis utilizes a wide range of tools, including moving averages, Fibonacci retracements, and chart patterns. These tools help traders identify entry and exit points, as well as potential areas of price reversal.

By examining historical price data, technical analysts seek to uncover repetitive patterns and trends that may indicate future market movements. This method assumes that historical price patterns can provide insight into the behavior and sentiment of market participants.

Fundamental and technical analysis are both important in forex trading, as they provide different perspectives on market trends and potential trading opportunities. While fundamental analysis focuses on economic factors and geopolitical events, technical analysis relies on historical price data and patterns.

By combining these two approaches, forex traders can develop a more comprehensive understanding of the market and make well-informed trading decisions. It’s important to note that no single analysis method guarantees success, and traders should consider a variety of factors and indicators when formulating their trading strategies. To learn more about different forex trading strategies, visit our article on forex trading strategies.

As you delve deeper into the world of forex trading, it’s essential to continuously educate yourself on both fundamental and technical analysis techniques. By staying informed about economic factors, political events, and market trends, you can enhance your trading skills and increase your chances of success in the forex market.

Best Practices for Forex Trading

To navigate the world of forex trading successfully, it is crucial to implement best practices that minimize risks and increase the likelihood of profitable outcomes. Here are some key practices to consider:

Risk Management in Forex Trading

Forex trading involves significant risks, including the potential for substantial financial losses (Investopedia). Implementing effective risk management strategies is essential to protect your capital and ensure long-term success.

One of the primary risk management techniques is setting appropriate stop-loss orders. A stop-loss order allows you to define the maximum amount of loss you are willing to tolerate on a trade. By setting a stop-loss level, you can automatically exit a trade if it moves against you, limiting potential losses.

Another important aspect of risk management is position sizing. It involves determining the appropriate lot size or number of units to trade based on the size of your trading account and risk tolerance. By keeping your position sizes within reasonable limits, you can minimize the impact of potential losses on your overall portfolio.

Choosing a Reliable Forex Broker

Selecting a reputable and reliable forex broker is crucial for successful trading. A reliable broker ensures fair execution of trades, provides access to a wide range of currency pairs, and offers competitive spreads and fees. Additionally, they should be regulated by a recognized financial authority to provide a level of security and protection for your funds.

When choosing a forex broker, consider factors such as the broker’s reputation, customer support, trading platform features, available account types, and regulatory compliance. Conduct thorough research and read reviews from trusted sources to make an informed decision.

Developing a Trading Plan

A well-defined trading plan is the cornerstone of successful forex trading. It outlines your trading goals, risk tolerance, trading strategies, and money management rules. A trading plan helps you stay disciplined and avoid impulsive decisions based on emotions.

Your trading plan should include specific criteria for entering and exiting trades, as well as guidelines for managing risk and monitoring your trades. Regularly review and update your trading plan as needed to adapt to changing market conditions and personal circumstances.

Continuous Learning and Adaptation

Forex trading requires a significant amount of knowledge, research, and monitoring (MoneySmart). To stay ahead in the forex market, it is crucial to continuously learn and adapt your trading strategies.

Stay updated with economic news, geopolitical events, and market trends that can impact currency prices. Enhance your knowledge by studying technical analysis, fundamental analysis, and various trading strategies. Regularly review your trading performance, identify strengths and weaknesses, and make necessary adjustments to improve your overall trading approach.

By continuously learning and adapting, you can refine your skills, stay informed about market developments, and make more informed trading decisions.

Implementing these best practices can enhance your forex trading journey, increase your chances of success, and minimize potential risks. Remember that forex trading requires discipline, patience, and a commitment to ongoing learning. By adopting a strategic and well-informed approach, you can navigate the forex market with confidence.